Your Salary

Salary after tax

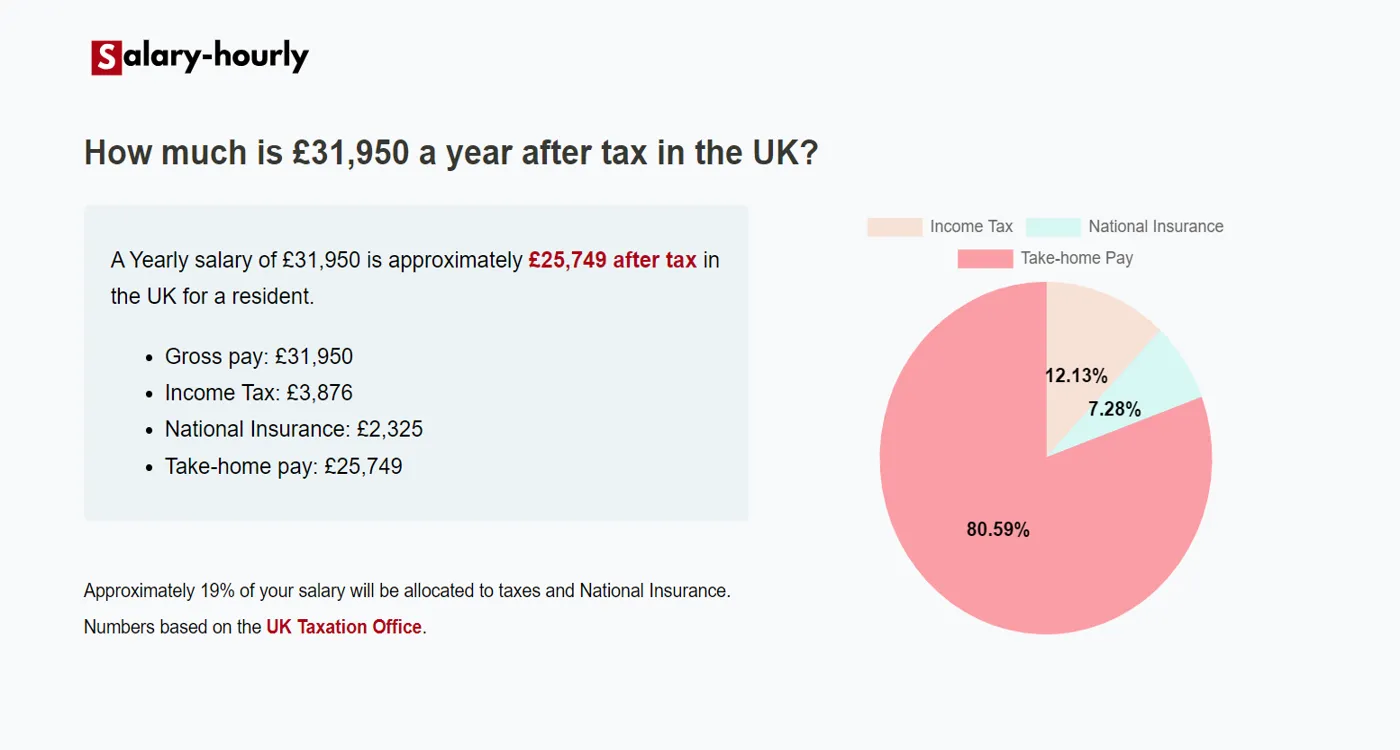

Take home pay: £25,749

Income Tax: £3,876

National Insurance: £2,325

Contribution Rate: 19%

A Yearly salary of £31,950 is approximately £25,749 after tax in the UK for a resident.

Approximately 19% of your salary will be allocated to taxes and National Insurance, equating to £3,876 in tax and £2,325 in National Insurance.

Numbers based on the UK Taxation Office.

| Salary Deductions | Yearly | Monthly | Biweekly | Weekly | Hourly |

|---|---|---|---|---|---|

| Gross Pay | £31,950 | £2,663 | £1,229 | £614 | £17 |

| Take-home pay | £25,749 | £2,146 | £990 | £495 | £13 |

| Income Tax | £3,876 | £323 | £149 | £75 | £2 |

| National Insurance | £2,325 | £194 | £89 | £45 | £1 |

Below are the tax brackets for the UK:

To calculate take-home pay in the UK, subtract the following from your gross salary:

The last tax year started on 6 April 2022 and ended on 5 April 2023.

A salary of £31,950 Yearly equates to approximately £17 per hour gross, and about £13 per hour net, after tax. This number is based on 37 hours of work per week and assuming it’s a full-time job (8 hours per day) with vacation time paid.

A salary of £31,950 Yearly equates to approximately £2,663 per month gross, and about £2,146 per month net.

A salary of £31,950 Yearly equates to approximately £614 per week gross, and about £495 per week net.

A salary of £31,950 Yearly equates to approximately £1,229 biweeky gross, and about £990 biweekly net.